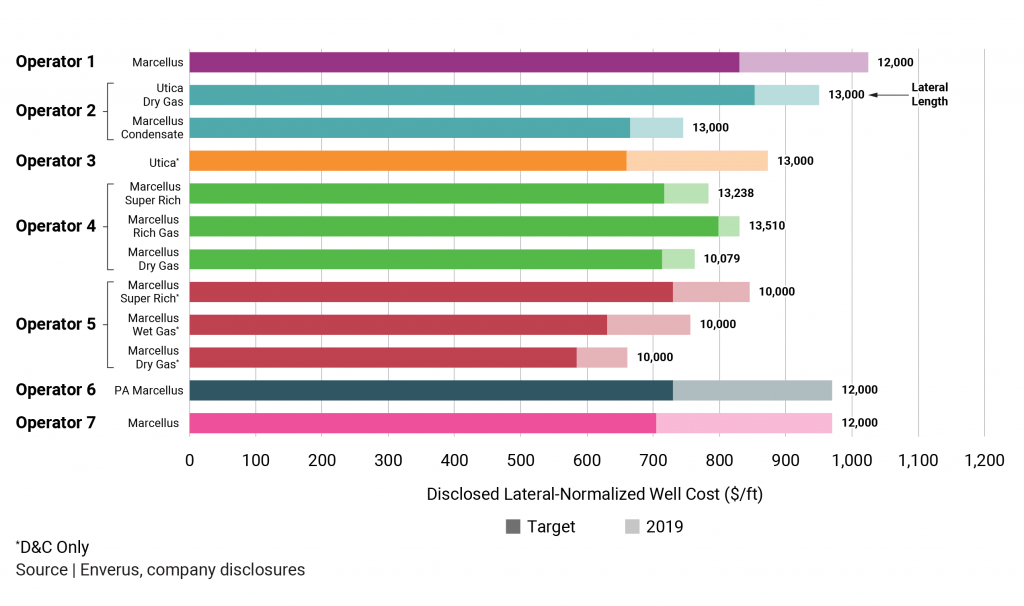

Appalachia Drillers Stretch Lateral Lengths To Improve Economics

With the 12-month forward strip for natural gas averaging $2.29/MMBtu in the first half of 2020, major Appalachia operators have been forced to drive well costs lower in a bid to support activity and maintain production under razor-thin margins. Rig counts in Appalachia dropped 48% from a year ago to 33, and the deterioration of […]

The Oil Patch Has Been Silent About COVID-19 — Let’s Speak Up!

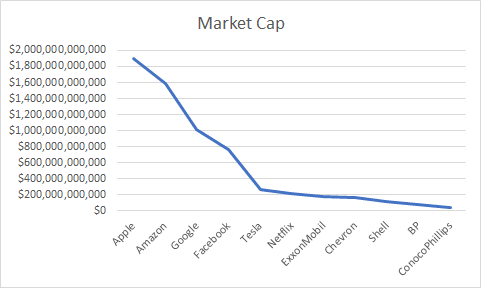

The recent announcement that America’s GDP contracted by 32.9% quarter over quarter, coupled with an increase in jobless claims to 1.4 million, sums up the economic impact that COVID-19 has had on our economy. With economic activity down, demand for energy — both the fossil kind and the renewable kind — is also down. Asset […]

Oilfield Services Metrics to Grow Market Share and Find Opportunities

Part 2: How to uncover opportunities with data analysis The first article of this series discusses the importance of detailed days sales outstanding (DSO) analysis and correlation to revenue generated for streamlined business processes, improved cost savings, and more informed strategy adjustments. This second article shows how leveraging your internal financial data with Enverus oil […]

Why DSO Matters for Better Cash Flow Management-Metrics for Oilfield Services

As the oil & gas industry reels from historically low prices, standard operating procedures no longer apply. With a global pandemic and uncertainty around the ability of the global oil industry to manage supply, the industry is between a rock and a hard place. Oilfield services (OFS) is the sub-segment in the industry most sensitive […]

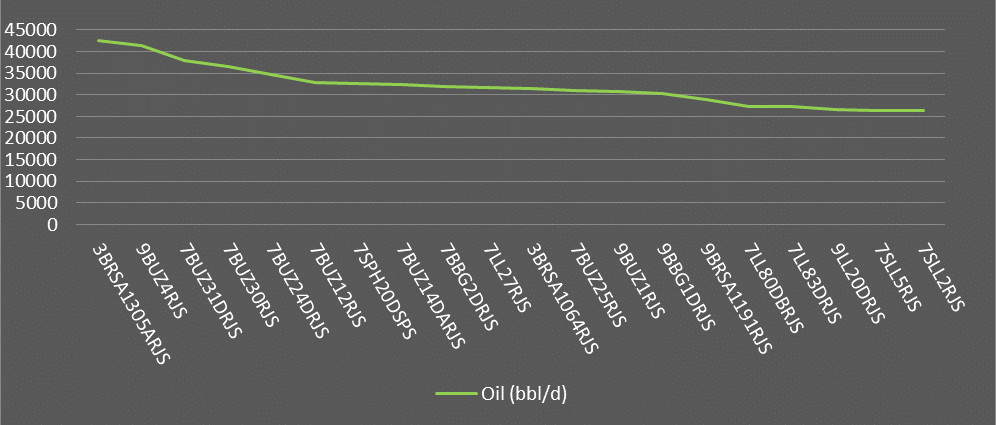

How Will COVID-19 and Low Oil Prices Impact Oil & Gas in Brazil?

As Brazil becomes a global hot spot for the COVID-19 pandemic, corporations and industries struggle with the logistical choices and challenges based on the need to rapidly adapt in the COVID-19 environment and the changed world that will emerge afterward. Most are focused on mere survival, but some companies may be able leverage the situation […]

Is the Past the Key to the Present for Oil & Gas?

Punditry is a great thing. Especially when it involves forecasting major economic changes that are expected to take place over years instead of weeks. It allows anyone to be wrong as often as they are right. So, all pundits are wrong at least half the time. Especially when they venture into the massively unpredictable oil […]

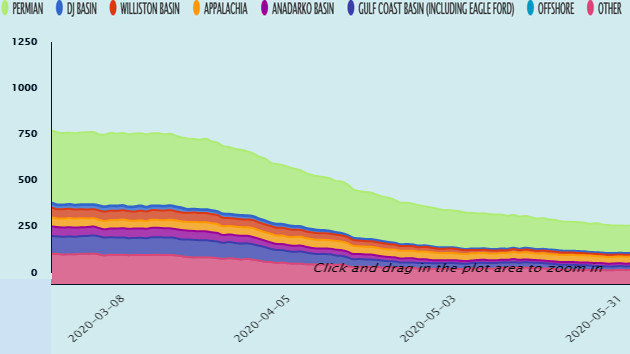

EIA Reports First Triple-Digit Injection of the Season

[contextly_auto_sidebar] Natural gas storage inventories increased 109 Bcf for the week ending May 1, according to the EIA’s weekly report, marking the first triple-digit injection of the season. This was above the expected injection of 105 Bcf. Working gas storage inventories now sit at 2.319 Tcf, which is 796 Bcf above inventories from the same […]

Prices Lose Gains With Substantial Inventory Build

[contextly_auto_sidebar] US crude oil stocks posted an increase of 4.6 MMBbl. Gasoline inventories decreased by 3.2 MMBbl and distillate inventories increased by 9.5 MMBbl. Yesterday afternoon, API reported a crude oil build of 8.4 MMBbl alongside a gasoline draw of 2.2 MMBbl and a distillate build of 6.1 MMBbl. Analysts were expecting a crude oil […]

Gas Injection Below Expectation While LNG Export Demand Weakens

[contextly_auto_sidebar] Natural gas storage inventories increased 70 Bcf for the week ending April 24, according to the EIA’s weekly report. This was slightly below the expected injection of 74 Bcf. Working gas storage inventories now sit at 2.210 Tcf, which is 783 Bcf above inventories from the same time last year and 360 Bcf above […]

Prices Up With Less Than Expected Inventory Build

[contextly_auto_sidebar] US crude oil stocks posted an increase of 9.0 MMBbl. Gasoline inventories decreased by 3.7 MMBbl and distillate inventories increased by 5.1 MMBbl. Yesterday afternoon, API reported a crude oil build of 9.98 MMBbl alongside a gasoline draw of 1.1 MMBbl and a distillate build of 5.5 MMBbl. Analysts were expecting a crude oil […]