Canadian Stage-by-Stage Completion Data – Plugging Along

What would you do if you had stage-by-stage data for an entire basin? At Enverus we use the data from over 5,000 Canadian unconventional wells, including data from over 175,000 stages, to complete detailed multivariate analysis that identifies the most influential completions variables to optimize production results. Interestingly, there was a clear bifurcation of results when […]

Lock It Down

With the recent surge in COVID-19 infections across much of the developed world, policymakers have started to re-introduce lockdown measures to control the spread. These efforts often restrict the movement of people in public spaces, reducing close contact to one another. France is currently under a national lockdown where people are only permitted to go […]

Net Reservoir Mapping – A Geologist’s Key to Reservoir Definition

When it comes to prospecting for hydrocarbon-bearing rock formations at the basin level, geologists utilize net reservoir maps to help define fluid-rich intervals within geological units. To develop an effective net reservoir map, knowledge of what geological properties separate productive rock from non-productive rock is essential. Positive production trends can be associated with geologic parameters […]

A Conventional Approach Could Pay Off for Investors

Oil and gas investors are no longer focused on rapid production growth and are placing more importance on a company’s ability to return value to shareholders. Favored companies have low sustaining capital efficiencies and the ability to generate free cash flow. This pivot by investors makes Canadian conventional plays, such as the Bakken, Shaunavon and […]

Tullow — Torn to Pieces or Swallowed Whole?

Sharks in the Water — Part Four Following our recent three-part series highlighting supermajors, and before we turn your attention to independent “sharks” — companies with solid balance sheets, long-term growth strategies and cash to spend on acquisitions from stressed rivals we want to offer our best guess as to where the remains of […]

The Oil & Gas Industry Searches for the Truth Amid COVID-19

These are great times for pundits. We consume so much conflicting data daily; it seems anyone can predict just about anything — proving their point by cherry picking data. It appears the economy has come roaring back. But has it? Wage growth has been stellar — at least it seems so when you ignore the […]

Credit Markets Reopen for Levered E&P Refinancing

Several exploration and production (E&P) companies in August accessed debt markets to refinance near-term maturities despite carrying higher-than-average debt loads. Antero Resources (AR), Range Resources (RRC), Southwestern Energy (SWN) and Occidental Petroleum (OXY) issued new bonds to repay debt coming due from 2021 to 2023 despite carrying one to three more turns of leverage than […]

Rig and Fracture Activity Response in Real-Time

Oilfield activity levels have changed rapidly in response to falling commodity prices this spring. Enverus’ near real-time activity analytics, however, show a stark difference in how completion and drilling activity is responding. This has important implications for operators, oilfield service providers and forecasters. Figure 1 displays the average monthly Lower 48 horizontal rig count and […]

Cash Flow or Grow?

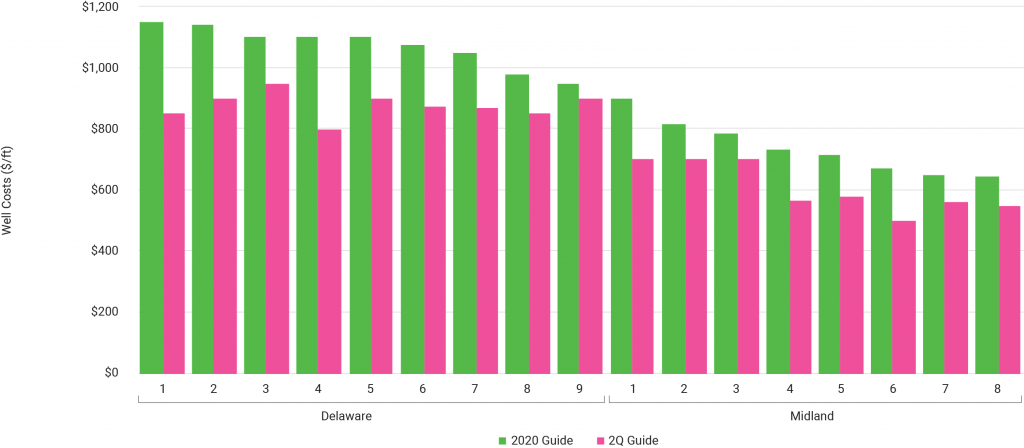

As second-quarter earnings season concludes, a major trend in the Permian was well cost savings from both efficiency gains and service cost reductions. Second-quarter guided well costs are down ~20% in the Midland and Delaware from initial 2020 budgets (Figure 1). Although how well these costs savings survive as rig count recovers is unknown, they […]

Quantifying Accounts Payable Automation: Savings Calculator

Every day, companies evaluate and make decisions to operate more efficiently and increase profitability. Evaluating those decisions can be a long, challenging process. One area of opportunity for many oil & gas companies to realize greater efficiency is through accounts payable automation. While digitization of your invoice process promises savings, you might be curious about […]